top of page

What a Global Investment Firm’s Shift Means for Your Family's Wallet

Published by Amanda Y | Finance Ever heard about a big company making a change, and you wonder, "So what? How does that affect me ?" Well, when a global investment firm like Arena Investors decides to close its Singapore office, it might seem far away from your grocery bill or your child's college fund. But actually, these big business moves are like weather patterns in the economy – they can signal broader changes that eventually reach your household. Think of it like this:

Amanda Y

Nov 17, 20253 min read

What Does Singapore's Digital Boom Mean for Your Child's Future ?

Published by Roy C | Finance Ever wonder what kind of jobs your kids might have when they grow up? It's a question every parent asks. Well, things are changing faster than ever, right here in Singapore. Our country isn't just embracing technology; it's practically built on it now. This isn't some far-off sci-fi movie; it's today's reality, and it has a direct impact on your children's success. A new report from the government's tech agency (IMDA) shows just how much our dig

Roy C

Nov 15, 20253 min read

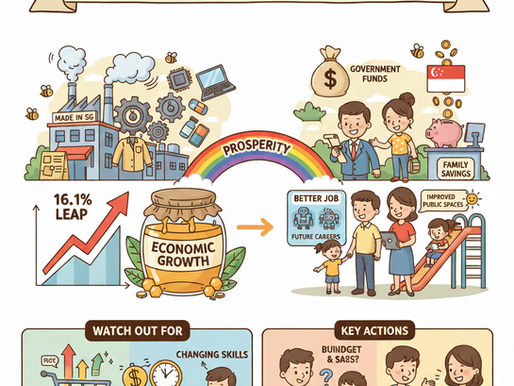

Singapore's Economy is Booming

Published by Matthew A | Finance As parents, our to-do list seems endless: packed lunches, school runs, homework help, and somehow, fitting in work! Amidst all this, you might not be regularly checking the news about Singapore's economy. But a recent headline about our factories suddenly producing way more goods(a massive 16.1% leap!) is actually bigger news for your family than you might think. Why? Because when economists get excited and upgrade their forecasts, it's not ab

Matthew A

Nov 13, 20253 min read

Your Groceries Just Got a Little Pricier: What Singapore's Rising Costs Mean for Your Family

Published by Rui En | Finance Ever felt like your weekly grocery bill keeps creeping up, even when you're buying the same things? Or perhaps that new pair of school shoes for your child seemed a little more expensive than you remembered? You're not imagining it. Recent news confirms what many Singaporean parents have been feeling: prices for everyday essentials are indeed on the rise. Economists recently announced that "core inflation" in Singapore nudged up to 0.4% in Septem

Rui En

Nov 11, 20253 min read

Leveraging DBS's Market Dominance for Your Financial Gain

Published by Rui En | Finance DBS Bank, one of Singapore's biggest banks, is pulling way ahead of its rivals, OCBC and UOB, in terms of its overall worth. Think of it like a race where DBS is now significantly in the lead. Why? Because investors (people who buy shares in companies) are super confident that DBS will keep paying out attractive dividends (a share of its profits) and is generally better at making money than its competitors. They're basically saying, "DBS is a rea

Rui En

Sep 21, 20253 min read

Monetary Authority of Singapore (MAS) New Shared Responsibility Framework: What It Means for Your Wallet

Published by Rik L | Finance You’ve likely heard the phrase, "It takes a village." Well, in Singapore, that same idea is now being applied to fighting scams. On September 15, 2025, the government rolled out a powerful new strategy called the Shared Responsibility Framework (SRF), and it’s set to change the digital safety landscape for everyone. But what exactly is it, and how will it impact you when you’re paying for your online shopping or making a big-ticket payment like a

Rik L

Sep 16, 20253 min read

Strategic Investing in Singapore for Long-Term Growth

Published by Grace K | Finance In Singapore's dynamic financial hub, staying ahead is not just an advantage. It is a necessity. For finance professionals, the local landscape presents a unique blend of global opportunities and robust domestic stability. But navigating this exciting terrain requires more than just market knowledge; it demands a disciplined and strategic approach to investment. How can you, as a seasoned professional, build a portfolio that not only grows but e

Grace K

Sep 12, 20252 min read

bottom of page